Complete Guide to Construction Accounting for Contractors

In the realm of financial management, accounting serves as an essential backbone for businesses. However, the unique nature of the construction industry necessitates a specialized approach to accounting. Here are the key differences between construction accounting and traditional accounting:

Project-Based Focus

Construction accounting is primarily project-oriented, focusing on individual jobs rather than the overall business. Each construction project has its own budget, expenses, and profits, and accountants must track these elements meticulously to determine the financial performance of each project. In contrast, traditional accounting typically treats business operations as a whole rather than breaking them down into separate projects.

Job Costing

In construction accounting, job costing is a critical component. This method involves tracking all costs associated with a specific project, including labor, materials, overhead, and subcontracting expenses. Accurate job costing allows contractors to assess profitability on a per-project basis. Traditional accounting may not delve into job-cost specifics, often summarizing costs at a more general level which can obscure project performance.

Contract Types and Revenue Recognition

Construction projects are usually governed by contracts that can vary widely in terms of payment structures—such as fixed-price, cost-plus, or time and materials contracts. These contractual arrangements significantly influence how revenue is recognized in construction accounting.

Revenue Recognition Methods in Construction Accounting

Revenue recognition is a crucial aspect of accounting, particularly in the construction industry, where projects can span several months or even years. Understanding the various revenue recognition methods is essential for accurately reporting financial performance and ensuring compliance with accounting standards.

Percentage of Completion

One common method used in construction accounting is the percentage-of-completion method. This approach recognizes revenue based on the progress of a project, allowing companies to report income as work is completed. This method provides a more accurate reflection of ongoing projects and helps stakeholders understand financial health over time.

Completed Contract Method

Another method is the completed-contract method, which defers all revenue recognition until a project is fully completed. While this approach simplifies accounting by avoiding estimates related to project completion, it may not provide timely insights into a company’s performance during long-term contracts.

Choosing the Right Method

Ultimately, selecting the appropriate revenue recognition method depends on various factors including project size, duration, complexity, and management’s ability to estimate future costs accurately. Consulting with accounting professionals who specialize in construction can help ensure compliance with relevant accounting standards while optimizing financial reporting strategies.

Managing Retainage and Cash Flow

Managing retainage and cash flow is a critical aspect of construction accounting that can significantly impact a project’s financial health. Retainage refers to the portion of payment withheld until the completion of a project to ensure that contractors and subcontractors fulfill their obligations. This practice, while common, requires careful management to maintain positive cash flow throughout the construction process.

Understanding Retainage

In construction accounting, it’s essential to track retainage accurately. This involves understanding the terms outlined in contracts and ensuring that all parties are aware of when retainage will be released. Effective communication with clients and subcontractors can help mitigate disputes related to payment delays.

Impact on Cash Flow

From an accounting perspective, retainage can create challenges for cash flow management. Contractors may find themselves in a position where they have completed significant portions of work but are unable to access all their earned revenue due to these withheld funds. This delay can strain financial resources, making it difficult for businesses to meet operational expenses, pay employees, or invest in new projects.

Moreover, understanding how retainage affects cash flow is crucial for effective budgeting and financial planning within construction projects. It’s essential for contractors to account for retained amounts when forecasting income and managing expenses throughout the duration of a project. By doing so, they can better navigate the complexities of cash flow associated with retainage and maintain healthier financial stability in their operations.

Payroll Management in Construction Accounting

Compliance with Wage Laws

Compliance with wage laws ensures that workers are paid fairly and on time, which not only fosters a positive work environment but also protects the company from potential legal disputes. This includes adhering to minimum wage standards, overtime pay regulations, and specific provisions related to prevailing wages in government contracts.

Union Regulations

Union regulations play a crucial role in determining how payroll is structured and managed within the construction industry. These regulations often dictate wage rates, overtime pay, benefits, and working conditions for unionized workers.

Construction companies must ensure compliance with these union agreements to avoid potential disputes or legal issues. This involves accurately tracking hours worked, calculating wages according to collective bargaining agreements, and maintaining proper documentation for audits. Additionally, payroll systems must be equipped to handle the unique requirements of different unions, which may include specific reporting formats and payment schedules.

Utilizing Accounting Software

Utilizing accounting software in the construction industry offers numerous benefits that can significantly enhance operational efficiency and financial management. One of the primary advantages is improved accuracy in financial reporting. By automating calculations and data entry, accounting software minimizes human error, ensuring that project budgets and expenses are tracked with precision.

Additionally, these tools provide real-time insights into cash flow and project costs, enabling construction managers to make informed decisions quickly. This level of visibility helps in identifying potential financial issues before they escalate, allowing for proactive management.

Key Features

Another key benefit is streamlined invoicing and payment processes. Accounting software can automate billing cycles, reducing the time spent on administrative tasks and improving cash flow by ensuring timely payments from clients.

Furthermore, many platforms offer features tailored specifically for the construction industry, such as job costing and contract management, which help track expenses against specific projects.

Benefits of Specialized Software

Essential Reports for Contractors

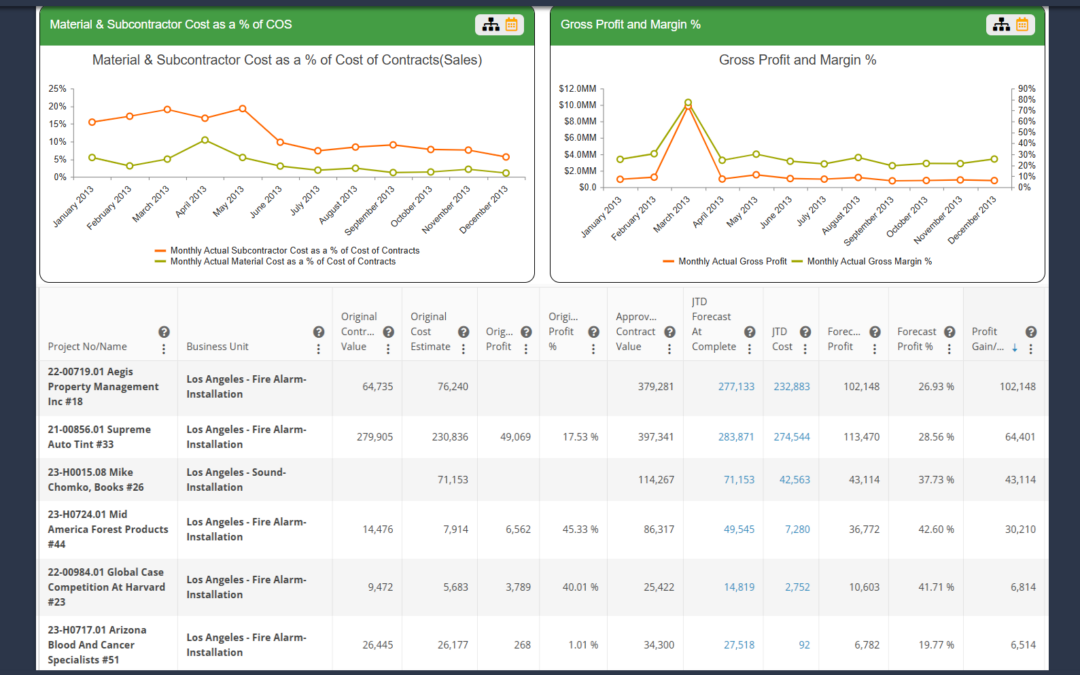

Utilizing construction accounting software can significantly enhance the financial management of contracting businesses. One of the key features of such software is its ability to generate essential reports that provide valuable insights into a contractor’s financial health.

Among the most critical reports for contractors are job costing reports, which detail the expenses associated with specific projects, allowing for better budgeting and resource allocation. Additionally, profit and loss statements help contractors assess their overall profitability by comparing revenues against expenses over a defined period.

Another vital report is the accounts receivable aging report, which tracks outstanding invoices and helps ensure timely payments from clients. This report is crucial for maintaining cash flow, a common challenge in the construction industry. Furthermore, project status reports offer real-time updates on project progress and financial standing, enabling contractors to make informed decisions quickly.

By leveraging these essential reports generated by construction accounting software, contractors can gain deeper insights into their operations, improve financial planning, and ultimately drive business success.

WIP Reports

WIP reports provide a comprehensive overview of a contractor’s ongoing projects, detailing the costs incurred versus the revenue recognized.

These reports are crucial for effective project management, as they help contractors assess their financial position at any given time. By analyzing WIP reports, contractors can identify potential cash flow issues early on and make informed decisions regarding budgeting and resource allocation. Furthermore, these reports facilitate better communication with stakeholders by providing transparent insights into project performance.

Incorporating construction accounting software that includes robust WIP reporting capabilities allows contractors to maintain accurate records, improve financial forecasting, and ultimately enhance profitability. As the construction industry continues to evolve, leveraging technology like this becomes increasingly important for staying competitive and ensuring successful project outcomes.

Financial Statements

Many construction accounting solutions offer customizable reporting features that enable users to create detailed financial statements specific to individual projects or overall company performance. This flexibility is crucial for contractors who need to monitor profitability across multiple jobs while adhering to budget constraints.

In summary, leveraging construction accounting software not only simplifies the generation of essential financial statements but also enhances overall project management efficiency by providing clear visibility into a company’s fiscal status.

The Importance of Specialized Construction Accounting

In conclusion, the importance of specialized construction accounting cannot be overstated. The unique financial challenges and complexities inherent in the construction industry necessitate tailored accounting practices and software solutions. Unlike traditional accounting, which may not account for project-based costs, specialized construction accounting focuses on job costing, contract management, and compliance with industry regulations.

Utilizing dedicated software designed for construction accounting streamlines processes such as budgeting, forecasting, and financial reporting. These tools enable construction firms to track expenses accurately against specific projects, ensuring that they remain within budget and can make informed decisions based on real-time data.

Moreover, specialized software often includes features that cater to the nuances of the industry—such as tracking change orders or managing subcontractor payments—further enhancing operational efficiency.

As the construction landscape continues to evolve with new technologies and methodologies, investing in specialized accounting practices is essential for companies aiming to maintain profitability and competitiveness in this dynamic environment.

The CFMA offers a great course on The Basics of Construction Accounting:

This course is designed for accounting professionals new to the construction industry, as well as non-accounting construction industry professionals who want or need a better understanding of construction accounting processes, construction cost management systems, job costs and job cost reporting, the WIP, and the most important elements of a contractor’s financial statements.

Want to learn more about how Anterra is a fit for your construction software needs?