What Is a WIP Schedule in Construction?

Nearly 9 out of 10 large-scale construction projects (85.5%) are delivered late, with almost a quarter (22.7%) being more than 250 days behind schedule.

To stay on track, construction companies use a Work-in-Progress (WIP) schedule to monitor job performance and keep projects financially stable.

In this guide, we will equip construction firms with the knowledge to create and use a WIP schedule effectively.

What are WIP Schedules?

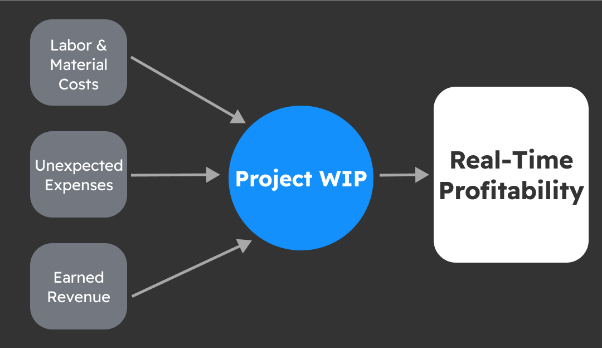

A Work-in-Progress (WIP) schedule is a financial report used in construction to track the status of ongoing projects. It shows the total contract value, costs incurred, revenue recognized, and the percentage of work completed.

For example, a construction company is building a $5 million commercial office space. At the halfway point, they have spent $2.5 million but completed only 40% of the work. A WIP schedule would flag this imbalance, helping the company adjust labor, materials, or billing to stay on track financially.

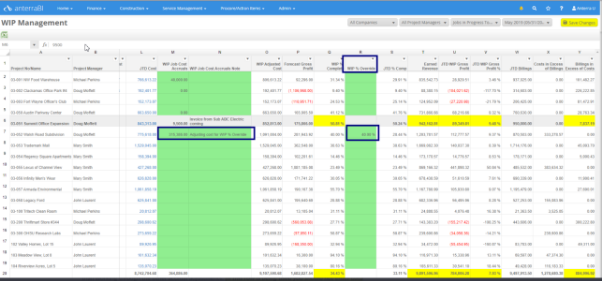

Here’s what a WIP schedule looks like:

Anterra’s automated WIP management system.

Anterra is an all-in-one solution for managing construction projects that provides automated WIP reporting. It’s easier than ever for construction firms to track project finances in real time.

Key Components of a WIP Schedule

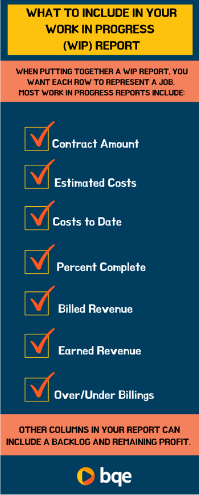

So, we know that WIP reports show a project’s financial health, but what information do you need to create one? Here’s what goes into a WIP report:

Contract Value

This is the total amount agreed upon for the project, including any approved change orders. Knowing the contract value helps contractors compare actual costs against the total budget and ensure they are billing correctly.

Costs Incurred to Date

This includes all expenses spent on the project, such as labor, materials, equipment, and subcontractors. Project managers compare actual costs to the budget. If costs are rising faster than expected, they need to investigate why.

Estimated Cost to Complete

This estimates how much more money is needed to finish the project. Its accurate forecasting ensures contractors have enough resources to complete the job without financial surprises.

Percentage of Completion

This is calculated by dividing the costs incurred by the total estimated costs. It helps determine how much work is done versus how much revenue should be recognized. If the completion percentage doesn’t match the on-site physical progress, billing or cost-tracking errors may exist.

Revenue Recognized

This figure shows how much income a contractor can report based on project progress.

Overbilling and Underbilling

Overbilling means invoicing ahead of actual progress, temporarily boosting cash flow. Underbilling happens when work is completed but not yet billed, creating financial strain.

Gross Profit

This is the difference between the revenue earned and the costs incurred. A declining profit margin could signal inefficiencies, delays, or unexpected expenses that need attention.

Backlog

Backlog is the total value of work that is contracted but not yet completed. A healthy backlog ensures a steady stream of future work and revenue, while a shrinking backlog may indicate a slowdown in business.

Cash Flow Projection

A WIP schedule helps predict future cash flow based on project progress and billing.

Change Orders

Approved and pending change orders affect the contract value and project costs.

Retainage

Retainage is the portion of the contract amount withheld until project completion. It affects cash flow, so tracking it ensures contractors know how much money is still tied up.

Job Status

All current projects should be labeled as active, completed, or delayed.

Benefits of Using a WIP Schedule

WIP schedules provide value to multiple parties, including contractors, stakeholders, and sureties.

Benefits for Contractors

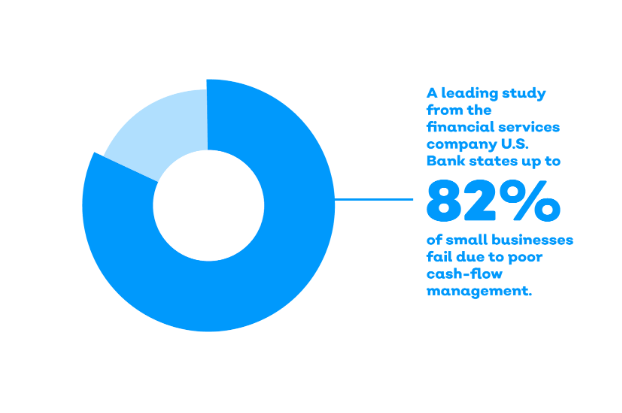

Better Cash Flow Management

A U.S. Bank study revealed that 82% of business failures are attributed to poor cash flow management. Contractors can track billing and expenses to ensure they have enough funds to cover labor, materials, and overhead.

Early Problem Detection

By comparing costs to budgeted amounts, contractors can spot overruns or inefficiencies before they become major financial issues.

More Accurate Financial Reporting

Approximately 78% of construction companies in the real estate sector experience projects running over budget, often due to inaccurate financial reporting and oversight. A work-in-progress schedule helps prevent that by:

- Tracking real-time costs to prevent budget overruns.

- Comparing actual expenses to estimated costs for better financial control.

- Identifying underbilling and overbilling to maintain steady cash flow.

- Highlighting inefficiencies early to avoid costly delays.

- Providing clear financial data for better decision-making.

- Improving forecasting for labor, materials, and cash flow needs.

Improved Project Planning

Studies indicate that about 30% of all projects experience cost overruns, defined as exceeding the planned budget by 20% or more. Work-in-progress accounting identifies potential delays or budget concerns, allowing for adjustments before they affect profitability.

Benefits for Stakeholders (Owners, Investors, Lenders)

Transparency in Project Performance

A survey of senior project executives revealed that, on average, construction projects exceed their budgets and schedules by 30% to 45%. These overruns often stem from poor financial tracking, unexpected costs, and inaccurate progress reporting. WIP reporting gives stakeholders real-time insight into how projects progress financially and operationally.

Better Decision-Making

WIP reporting helps investors and lenders assess financial health before approving loans or additional funding.

Benefits for Sureties (Bonding & Insurance Companies)

Risk Mitigation

Unbonded construction projects have been found to default up to 10 times more often than bonded projects. Sureties and insurance companies assess a contractor’s financial health before issuing bonds, and a well-maintained WIP schedule is one of the key tools they use in that evaluation.

Easier Bond Approval

Notably, 75% of project owners have reported that surety bonding reduces contractor pricing by an average of 3.2%. This means contractors who secure bonds are considered lower-risk, making them more competitive in project bidding.

However, obtaining a surety bond requires proof of financial stability and responsible project management. This is where a WIP schedule becomes essential.

Best Practices for Managing a WIP Schedule

A well-managed Work-in-Progress (WIP) schedule helps construction firms maintain financial stability, prevent cost overruns, and improve project efficiency.

Companies should follow these best practices to get the most out of WIP reporting.

Automate WIP Reporting

Instead of manually tracking everything, construction firms can improve accuracy and efficiency by using automated WIP reporting tools. Anterra provides financial management with industry-leading tools, enhancing revenue recognition accuracy, reduces errors, and simplifies the reporting process.

By automating WIP schedules, contractors can:

- Access real-time real-time insights with construction dashboards.

- Eliminate manual data entry and reduce the risk of miscalculations.

- Ensure timely and accurate revenue recognition.

Get a live, one-on-one demo with Anterra’s senior consultant.

Foster Collaboration Between Project Managers and Accountants

Construction projects that employ effective collaboration techniques are 33% more likely to finish on time and 15% more likely to stay within budget.

Project managers know firsthand job progress, resource allocation, and on-site challenges, while accountants oversee financial reporting and cost tracking.

With collaboration, financial data becomes connected to actual project conditions. To improve collaboration:

- Hold regular WIP review meetings.

- Ensure project managers understand key financial metrics.

- Use shared digital platforms.

- Encourage open communication.

Standardize WIP Reporting Across Projects

Standardizing WIP reporting ensures that every project follows the same structure. Use a uniform WIP template across all projects. Establishing clear reporting deadlines (monthly or quarterly) is also a good practice to maintain consistency.

Incorporate Change Orders Immediately

Change orders can drastically impact a project’s budget and schedule. If they aren’t included in the WIP schedule, they can lead to inaccurate cost and revenue tracking. Therefore, they must be approved and documented immediately to paint an accurate picture.

How to Create a WIP Schedule (Step-by-Step)

Here, project managers can follow these steps to create an effective WIP schedule:

Step 1: Gather Project Financial Data

Before creating a WIP schedule, you need accurate financial data for each active project. Without up-to-date numbers, a WIP report will be inaccurate and may lead to poor decision-making.

Collect the following financial data for each project:

- Contract Value: The total agreed-upon project price, including approved change orders.

- Estimated Total Costs: The expected total cost to complete the project, covering labor, materials, equipment, and overhead.

- Costs Incurred to Date: All project expenses paid or accrued up to the reporting date.

- Billed Revenue: The amount invoiced to the client so far.

- Unbilled Revenue: Earned revenue that has not yet been billed can impact cash flow.

- Remaining Costs to Complete: The projected amount still needed to finish the project.

- Change Orders: Approved and pending changes that affect project costs and revenue.

- Retainage: The portion of billed revenue held back by the client until project completion.

Step 2: Calculate the Percentage of Completion

The cost-to-cost method is the most common way to calculate the completion percentage.

Percentage of Completion = (Total Estimated Costs / Costs Incurred to Date) × 100

For example, if a project has an estimated total cost of $1,000,000 and $400,000 has been spent so far, the percentage of completion would be 40%.

Step 3: Determine Revenue Recognized

Revenue recognition follows the same percentage-based approach. By multiplying the completion percentage by the contract value, you can determine the revenue that should be recorded.

Revenue Recognized = Percentage of Completion × Contract Value

Step 4: Identify Overbilling and Underbilling

- Overbilling occurs when billed revenue exceeds work completed—this can help short-term cash flow but may cause problems later.

- Underbilling happens when work is completed but not billed, leading to cash shortages.

Step 5: Calculate Gross Profit

To calculate gross profit, subtract the costs incurred to date from the revenue recognized. This clearly shows how much money is being made on a project at any given time.

Gross Profit = Revenue Recognized − Costs Incurred

For example, if a project recognizes $800,000 in revenue and incurs $600,000 in costs, the gross profit would be $200,000.

Step 6: Forecast Costs to Complete

Look at the costs incurred and compare them to the original budget. Identify if expenses align with estimates or if costs rise faster than expected.

Break down what tasks are still unfinished and estimate their costs. Consider:

- Labor hours required to complete the job.

- Materials that still need to be purchased.

- Equipment rentals or purchases.

- Subcontractor fees for remaining work.

- Any unexpected issues or delays that could increase costs.

If approved or pending change orders exist, factor them into the forecast.

Use this simple formula to project the remaining costs:

Estimated Cost to Complete = Total Estimated Costs − Costs Incurred to Date

For example, if a project was initially estimated to cost $1,000,000 and $700,000 has already been spent, the estimated cost to complete would be $300,000.

Alternatively, construction companies can use Anterra’s advanced forecasting tools for projects.

Step 7: Review and Update Regularly

To keep financials accurate, a WIP schedule must be updated monthly or quarterly. Additionally, WIP reports should be shared with all stakeholders, lenders, and sureties.

To make this process easier, use Anterra’s powerful WIP management tools. Watch this video to explore how Anterra simplifies Work In Progress (WIP) reporting.

Common Mistakes in WIP Accounting

Here are the most common mistakes contractors make in WIP accounting and how to avoid them.

Delayed or Inconsistent WIP Reporting

Some contractors only update WIP schedules quarterly or inconsistently, leading to outdated financial data. This makes it harder to detect cost overruns, track cash flow, or adjust project strategies in real-time.

How to Avoid It: Establish a monthly WIP reporting schedule to avoid potential issues. Use automated WIP reporting tools like Anterra to streamline data collection and maintain accuracy.

Not Using WIP Reports for Decision-Making

Some contractors treat WIP schedules as compliance documents rather than tools for improving financial management. Without analyzing WIP data, businesses miss opportunities to optimize cash flow, adjust staffing, or negotiate better contract terms.

How to Avoid It: Use WIP reports proactively to measure financial performance and make data-driven decisions. Train project managers and accountants to interpret and act on WIP data effectively.

Misclassifying Retainage

Retainage is money withheld by the client until project completion. It is often mistakenly recorded as revenue instead of a receivable. This distorts financial reports, giving the impression that more cash is available than what’s accessible.

How to Avoid It: Properly classify retainage as an asset (accounts receivable) rather than revenue. Track when retainage is expected to be released to avoid cash flow issues.

Conclusion

Many contractors rely on experience and instinct to track project finances rather than structured WIP reporting.

However, as construction costs rise and profit margins tighten, traditional methods no longer provide the accuracy or speed needed to compete. Progress comes from embracing better tools, automation, and real-time financial insights.

Don’t let outdated reporting hold your business back. See how automation can help your construction financial management. Schedule a live demo with an Anterra today.

FAQs

What is the difference between a WIP schedule and a balance sheet?

A WIP schedule tracks project-specific financial data, showing ongoing jobs’ progress, costs, revenue, and profitability. On the other hand, a balance sheet is a company-wide financial statement that summarizes assets, liabilities, and equity at a specific time.

Who should manage WIP schedules?

The accounting department typically manages WIP schedules in the construction industry, but project managers must also be involved to share on-site progress and cost details.

What is the role of WIP schedules in tax reporting?

WIP schedules impact revenue recognition, which affects how and when a company reports income for tax purposes. If revenue is overstated, the company may pay more taxes than necessary. Contractors should follow FASB guidelines to ensure compliance with revenue recognition and cost allocation standards.