What is a WIP Schedule in Construction?

Growing up, we’ve all seen the Work in Progress (WIP) sign sitting at a construction site. In construction projects, however, the phrase WIP schedule carries a much deeper meaning. It’s a document contractors make to track the financial and operational progress of a project. Creating it manually can create a mess because so many calculations are involved. That’s why it’s recommended to leave construction financial management to industry-leading tools.

Let’s walk you through a detailed guide to everything WIP report stands for and things that go into making it.

What is a WIP Schedule?

A Work in Progress schedule (WIP) is a financial and project management document that tracks the ongoing status of construction projects. To this end, it shows the costs incurred, revenue earned, and progress made. By capturing these details, you get a picture of how much of the contract is complete and what still needs to be billed. Without a WIP schedule, it’s easy to lose track of what’s owed and how much has been earned.

A typical construction work in progress schedule includes essential data like the:

- Total contract value

- How much has been billed

- Costs to date

- Estimates of what’s needed to finish the job

For example, if you notice that your cost to complete figures is climbing faster than expected, it might signal delays or unforeseen expenses. Catching these issues early lets you adjust budgets or negotiate with clients before things spiral. Stakeholders, like banks and surety companies, often use WIP schedules to evaluate a contractor’s financial standing. Surety companies, for example, require an up-to-date WIP report before issuing bonds. These schedules give them a clear view of whether a contractor is over-committed or managing their projects effectively. Lenders also use the WIP report to understand whether the construction business can handle its current workload while maintaining profitability.

Key Components of a WIP Schedule

Let’s dig into the nuts and bolts of what makes up a WIP schedule.

Contract Value

The contract value is the agreed-upon price for the entire project. If a contractor signs a $1 million deal to build a school, that’s the contract value. To make sure you’re not caught off guard by unexpected costs or client disputes later in the project, staying on top of the contract value is necessary.

Costs Incurred to Date

This component tracks the actual expenses spent on the project so far. It includes everything from labor and materials to subcontractor fees. If you’re building a commercial plaza and have already poured the foundation, those expenses show up here. Tracking these costs flags overspending early which gives you time to course-correct before it’s too late.

Total Estimated Cost

This cost reflects the projected expenses required to complete the project. For example, if you’re halfway through a project with $500,000 spent, and you anticipate $500,000 more to finish, your total estimated cost remains $1 million. By tracking this figure, teams forecast whether the job will stay profitable or veer into trouble due to unexpected costs.

Project Billings

Project billings show how much of the contract value has been invoiced to date. This number includes progress payments and any upfront deposits. For example, if you’ve billed $400,000 on a $1 million project, you’re 40% into your invoicing.

Gross Profit to Date

Gross profit to date calculates the earnings generated by the project after accounting for costs incurred. If a project has brought in $600,000 in revenue and $400,000 in costs, the gross profit stands at $200,000. You calculate this metric to assess whether a job is on track to meet financial goals or if adjustments are needed to stay in the black.

Underbillings

If your team has completed $500,000 worth of work but billed only $400,000, that $100,000 gap is due to underbilling. Underbillings occur when the value of work completed surpasses what has been billed. While it occasionally happens, too much underbilling can cause cash flow headaches.

Overbillings

Overbillings, on the other hand, happen when you’ve billed more than the value of the work completed. While this may seem like a good position, it can create problems later like future cash flow taking a hit or client relationships getting affected.

Benefits of Using a WIP Schedule

Let’s explore the benefits of a work in progress schedule for everyone involved.

Contractors

A WIP report is a contractor’s dashboard. Using it, they track the financial and operational health of each project to make smarter decisions later on. Let’s say you’ve already burned through 75% of the budget but only completed 50% of the work, a WIP report sounds the alarm before things spiral out of control.

Contractors can also:

- Detect inefficiencies

- Address cost overruns

- Recalibrate their strategies

Stakeholders

Project owners, investors, and other stakeholders benefit from WIP schedules by gaining a clear view of a project’s financial trajectory. These reports shine a light on potential red flags like delayed schedules, bloated expenses, or cash flow hiccups.

Sureties

Surety companies want to see contractors completing jobs efficiently. If a contractor consistently underbills or overextends resources, it signals potential risks that could lead to project delays or default. But when a WIP schedule demonstrates consistent progress, surety companies rest assured that the contractor is on solid footing.

Best Practices for Managing a WIP Schedule

A well-maintained WIP schedule report brings the above-mentioned entities on the same page. But that takes keeping the report accurate and actionable. Let’s explore the best practices that help you do exactly that.

Regular Updates Keep You in the Game

Consistency in updating your WIP schedule is non-negotiable. Ideally, this should happen monthly to align with the fast-paced nature of construction work. This is because monthly updates satisfy requirements for bonded work, as sureties often insist on current financial details, especially during new or high-value projects. Skipping this step or relying on quarterly updates risks unforeseen cost overruns or cash flow crunches.

Collaborate with Project Managers and Accountants

Sitting down with project managers and accountants each month to review the latest numbers keeps everyone on the same page. The report sparks discussions that reveal small but important details behind the data. These very discussions help you make strategic decisions to keep everything on track. Without this collaboration, you’re left with a static report that fails to reflect the project’s reality.

Don’t Overlook Indirect Costs

Equipment depreciation, temporary utilities, or administrative expenses are all indirect costs. They can quietly eat into your project’s profitability if not accounted for correctly. Accurately logging your indirect costs is also necessary for maintaining credibility and securing future opportunities because sureties and bonding agents pay close attention to them.

Stay on Top of Your Expected Margins

Profit margins can be slippery and vary from job to job. A sudden dip in profits could hint at untracked expenses, while an unexplained spike might signal overly conservative budgeting. So regularly revisit and record these numbers in your WIP report to keep surprises at bay.

Keep Your Surety Partners in the Loop

Sureties want to see that you’re managing costs responsibly and making progress as planned. They might require monthly updates if the project is larger than usual for you. This gradually builds trust after which you may move to quarterly reporting.

Manage Billings with Precision

Both underbilling and overbilling can derail a project faster than you’d think. The former can create cash flow issues while the latter raises red flags with sureties. So handle billing very carefully.

How to Create a WIP Report

Drawing valuable insights from your WIP report requires gathering accurate data while creating it. But how does WIP report construction really work? Let’s understand it one step at a time.

Step 1: Gather All Necessary Data

Get all the information you can about the project. Calculate the total estimated cost of the project, including, but not limited to, labour, materials, and overhead. Then add the project’s start date, anticipated timeline, and scope of work. You can get into the nitty-gritty after that. Tasks finished, hours worked, crew members’ identities, and more are all part of this. If you don’t carefully write everything now, it will cause you trouble later.

Step 2: Organize the Collected Information

Now categorize your information into relevant sections to reduce the clutter. For example, the following may deserve their own sections:

- Costs

- Timelines

- Progress percentages

- Labor allocation

Step 3: Update the WIP Report to Reflect Adjustments

Now calculate important metrics and check that the outcomes are true. Once you’re done with calculations, look for trends or warning signs in them. Are costs climbing faster than expected? Is progress lagging behind the timeline? Ask yourself all such questions and you’ll start seeing trends and gaps. Suppose you found that material costs were 10% lower than expected. You should update your predictions so that they are more precise in the future.

Regularly update your WIP schedule based on such findings and it will stay relevant.

Calculate Work in Progress

Calculating work in progress schedule shows whether your project has been overbilled or underbilled. In the last section, we moved past quickly from the calculation part. So let’s discuss how to calculate the WIP schedule in detail.

Step 1: Calculate the Percentage of Work Completed

Calculating this requires two things, actual costs to date and revised estimated costs. Here, actual costs to date include every dollar spent on labor, materials, equipment, and any subcontractor fees. Revised estimated cost is the difference from the original contract value due to things like materials prices increase or unexpected delays.

With these in hand, here’s the formula: Percentage of Work Completed = Actual Costs to Date ÷ Revised Estimated Costs

Compute Earned Revenue to Date

Using the percentage of completion, calculate the earned revenue by multiplying it by the total estimated profit.

Earned Revenue =Percentage of Work Completed × Total Estimated Profit

Here, estimated profit is the difference between the total contract value and the revised estimated costs.

Identify Overbilling or Underbilling

Subtract the earned revenue from the billed-to-date amount after accounting for actual costs, and you’ve determined whether the project is overbilled or underbilled.

Billed to date – Cost to date – Earned revenue = positive (overbilled) or negative (underbilled)

Advanced Techniques in WIP Management

Want your WIP report to be right every time? The following advanced techniques can help:

- Allocating Indirect Costs Accurately: This technique ensures that each project carries its fair share, not more, not less. Office overhead, equipment depreciation, and other similar expenses all fall under indirect costs. So allocate these costs accurately because a slight misallocation here can make even a solid WIP report look shaky.

- Understanding Expected Margins: Your WIP report gives you a sneak peek of the future, especially in terms of profitability goals. Expected margins help you measure whether the job is on track financially or if adjustments are needed. To avoid any bigger problems later on, start keeping a close eye on expected margins from the beginning.

- Managing Billings: Underbillings and overbillings, both are extremes and you need to avoid them. The trick for that is updating your WIP schedule regularly as that keeps billing and actual project milestones in line.

Common Mistakes in Work in Progress Accounting

Small mistakes can lead to big headaches, especially when finances are involved. Avoid making the following mistakes during WIP schedule construction:

- Incomplete or Inaccurate Data Entry: Missing or incorrect entries will skew your calculations. You can either end up overestimating profits or underbilling your client both of which will leave you scrambling to correct the numbers later.

- Inconsistent Reporting Periods: A WIP report only works if it’s consistent. Shifting reporting periods creates a mismatched timeline that’s hard to reconcile. So make sure your regular updates follow a fixed industrial standard.

- Failure to Update Estimates: Sticking to outdated cost or timeline estimates gives a false sense of security. You don’t want to stay in the dark about your project going over budget or falling behind, do you?

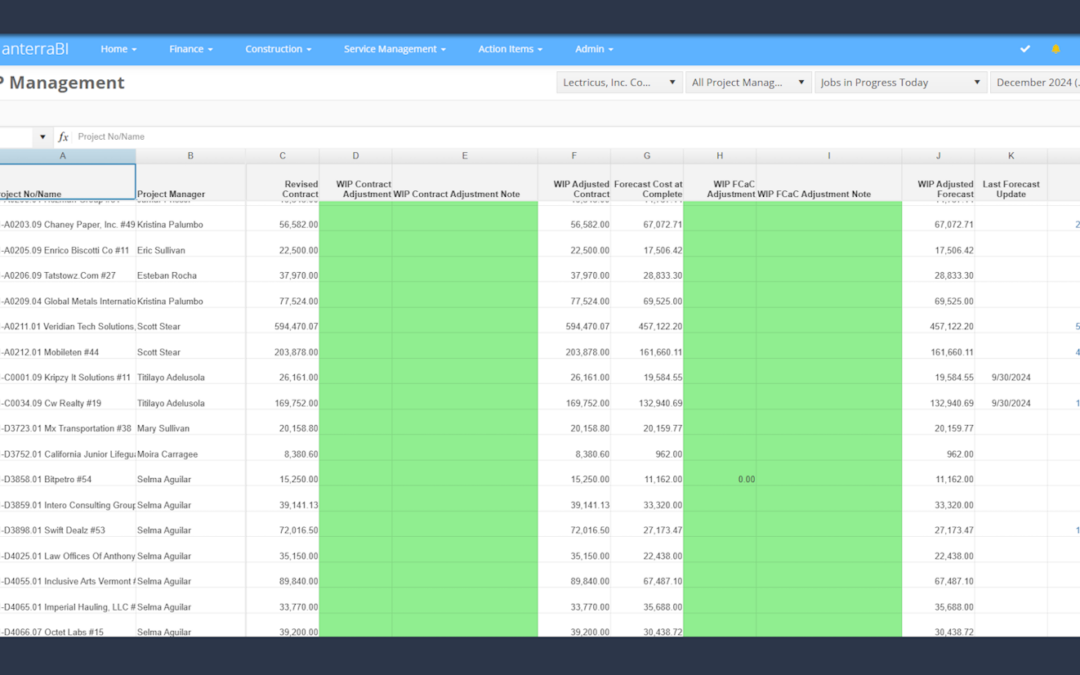

Anterra Automated WIP Reporting to The Rescue!

Getting the details right in your construction WIP schedule is a must. Powerful WIP management tools like Anterra reduce manual errors by automating most of the process. In addition, you get real time insights with construction dashboards into performance and financial health of the project. As a result, you start making data-informed decisions as well as proactively fixing inaccuracies before they can lead to bigger problems.

Interested? Get a free demo and see the difference it makes.

FAQs

What are the most common errors in WIP schedules?

The most common errors in WIP schedules include:

- Inaccurate data, such as incorrect project costs or completion percentages, can distort the entire report.

- Inconsistent reporting periods make it difficult to track trends or compare progress.

- Failing to update estimates as new information arises leads to outdated schedules, which can result in mismanagement of resources and cash flow issues.

Who should manage WIP schedules?

WIP schedules should be managed collaboratively by the accounting team and project managers. Accountants are responsible for ensuring data accuracy and compliance, while project managers provide real-time updates from the field. Together, they maintain an accurate and up-to-date WIP schedule which helps in making informed decisions about costs, timelines, and resource allocation.